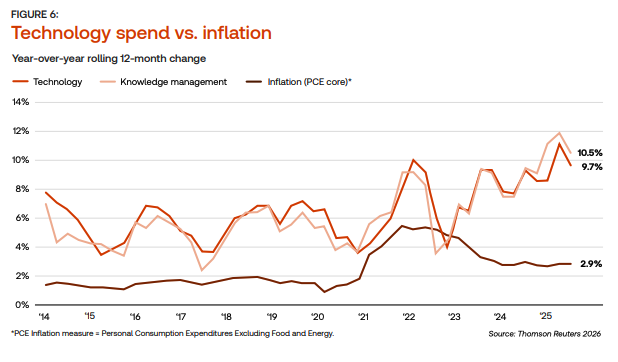

The US legal market in 2025 celebrated record profits while standing on increasingly unstable ground, Thomson Reuters’ 2026 state of the market report out today (7 January) finds. The average law firm celebrated 13% profit growth in 2025 and demand surged to the best year of growth since the global financial crisis (GFC). Technology spend grew on average nearly 10% and talent costs rose by 8.2% compared to 2024 levels.

However, the report, produced by the Thomson Reuters Institute and the Center on Ethics and the Legal Profession at Georgetown Law, says that growth is being driven by geopolitical instability and that a rush to grow and invest in technology without a clear strategy or changing business model is creating a precarious environment for firms.

“What makes this moment particularly treacherous is that the very forces creating today’s peaks are simultaneously undermining the ground beneath them,” the report says. “The surge in demand that’s lifting profits to record heights stems not from economic health but from chaos — trade wars, regulatory upheaval, and geopolitical tensions – all of which require constant legal navigation.”

More specifically, the second Trump administration has created a regulatory and geo-economic shock that has altered global markets, with the US at the epicentre.

While firms are racing to load up on talent and tech, the report says: “…firms are spending like the current revenue conditions represent a permanent shift rather than a temporary spike. History suggests otherwise. The legal industry has surged like this before — in 2007 before the GFC, and in 2021 before an inflation crunch — and each time, firms that mistook altitude for stability found themselves falling furthest when conditions shifted.”

When it comes to technology investment specifically, firms have found themselves in an arms race, but the report warns that the winners will not necessarily be the firms that spend the most, but those whose AI plans are strategic and intentional, backed by a changing cost structure.

“Yet for all this technological transformation, the fundamental law firm business model remains stubbornly unchanged,” the report says. “According to Thomson Reuters Legal Tracker data,10 a full 90% of all legal dollars still flow through standard hourly rate arrangements — the same billing structure that’s dominated since the 1950s. This creates an almost absurd tension that sees firms deploying technology that can accomplish in minutes what once took hours, then trying to bill for it by the hour. The math doesn’t work unless firms can negotiate rate increases steep enough to offset the efficiency gains; however, clients aren’t eager to see all their productivity benefits flow straight to law firm profits. Nor are they prepared for the sticker shock of a $2,000 hourly bill from an associate, even if what they’ve accomplished in that time may have taken 10 hours to complete previously.

“The result is a standoff that would be comical if the stakes weren’t so high. Client interviews reveal that corporate legal departments want their outside law firms to propose innovative billing solutions that incorporate AI’s efficiencies, while law firms complain that clients still evaluate everything by converting it back to hourly rates. Why spend months developing a sophisticated value-based pricing model when the procurement team will just divide the total by estimated hours and compare it to last year’s rates?

“Both sides are waiting for the other to blink first, meanwhile continuing to operate under a billing system that makes less sense with each passing quarter. Making matters worse, most clients don’t even know if or how their outside firms are using GenAI —a disconnect that suggests neither side is having the honest conversations necessary to break the impasse.”

Aside from the reference specifically to ‘GenAI,’ these paragraphs could have been written years ago.

The report warns that much as the GFC triggered a law firm-client revolution, GenAI threatens to trigger a similar revolution if the cards fall in the wrong way. “Corporate legal departments armed with both Big Law expertise and AI capabilities wouldn’t just negotiate harder on rates, they might stop needing outside firms for entire categories of work.

“The firms that survive and thrive will be those that get ahead of this shift now, while demand is strong and resources are available, rather than waiting for the next crisis to force their hand.”

The post Thomson Reuters’ State of the US Legal Market report – Record profits and increasingly unstable ground appeared first on Legal IT Insider.