By Neil Cameron

The 2025 update to the UK Top 200 technology table shows a market where the era of large-scale core-system churn is mostly behind us, at least for now. In practice management and document management, a small number of vendors account for the overwhelming majority of deployments, and for most firms the story is about completing existing programmes and tightening what they already have, rather than embarking on wholesale replacements.

The striking change since 2022 is less about the list of logos than the clarity of the map. The “unknown” and “not disclosed” entries that cluttered earlier tables have almost disappeared. For the first time we can also talk about the shape of the Gen AI market with real confidence rather than anecdote: just over two in five firms now list at least one Gen AI tool, and those that do average nearly two tools per firm.

That does not mean the core is completely frozen. At the very top of the table, Norton Rose Fulbright’s decision to move from a Fulcrum/SAP combination to Aderant Sierra shows that even the largest firms will reopen fundamental PMS choices when the cloud strategy demands it. By contrast, Clifford Chance remains on a 25-year-old, two-system Keystone/Aderant arrangement – a solution that is, by any reasonable standard, well overdue an overhaul. Together they illustrate the tension at the top end: one global firm committing to a new PMS platform, another still living, for now at least, with a legacy stack that everyone knows cannot last indefinitely.

Around these largely consolidated cores, investment continues to shift decisively towards workflow, collaboration, pricing, business intelligence and AI. Cloud has become the default delivery model rather than a differentiator, and the most interesting questions in 2025 concern what firms are building on top of their established stacks: how they orchestrate processes across PMS and DMS, how they present work to clients, and how they exploit data and Gen AI to improve costing, profitability and service. In short, the story of 2025 is still mostly not about who runs which PMS or DMS – the broad battle lines there are drawn – but about how firms are wiring everything else, including multiple overlapping Gen AI layers, around those systems.

Big Law vs Smaller Law

In technology terms, the meaningful dividing line is not “Top 200 vs the rest” but two tiers within the Top 200.

At the very top – roughly the Top 30–40 – firms behave like global corporates. They almost all have fully-fledged stacks around the core PMS/DMS: dedicated BD platforms (often DealCloud or an augmented InterAction), HighQ or equivalent collaboration as standard, specialist transaction tools, proper data platforms (Power BI plus something like Katchr or Iridium), layered security, and multiple AI/Gen AI tools running in parallel. Almost half of this cohort now have at least one Gen AI product in the table, and several list three or more. These firms treat workflow, pricing and AI as ongoing programmes, not one-off projects, and are beginning to converge on “AI platforms” rather than isolated point tools.

The next band – roughly 40–70 – still looks broadly “large firm” in PMS/DMS terms – the same Elite/Aderant plus iManage/NetDocuments stack – but adoption of the extra layers is more selective. Around a third have a Gen AI system, often a single flagship product such as ndMAX/ndMAX Assistant or CoPilot, rather than the multi-tool mosaics seen at the very top.

Below about 70, the pattern changes again. The core systems are still recognisably modern, but you see far more “single-tool” decisions: one main workflow product, little or no formal low-code, a single CRM that may not be heavily integrated, ad-hoc pricing models in Excel/Power BI, and a narrower set of AI/Gen AI deployments. Interestingly, Gen AI adoption here is not dramatically lower than in the top tier – around 44% of firms in the 71–200 range now list at least one Gen AI product – but those deployments are thinner and more tactical: a CoPilot rollout, ndMAX in the DMS, a single cloud-AI assistant in one practice group.

The real separation is no longer about which PMS or DMS they run – that has homogenised across a big chunk of the table – but about how much extra stack gets layered on top, and how coherently firms are integrating workflow, data and multiple AI engines.

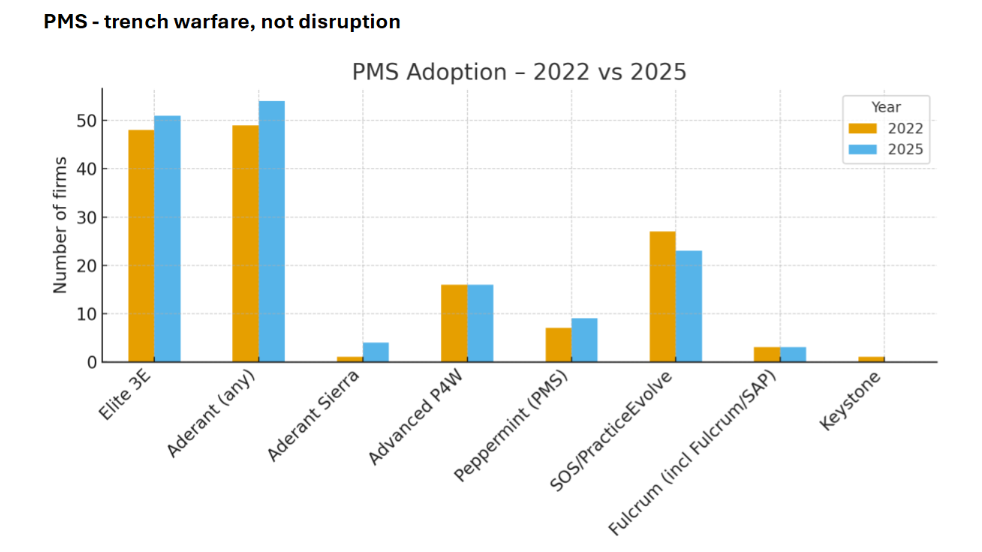

PMS – trench warfare, not disruption

PMS – stability on the surface, upheaval at the very top

At first glance the PMS chart still looks like a story of incremental change. Among the top 200 firms, Elite 3E rises from 48 to 51 sites between 2022 and 2025, and Aderant from 49 to 54, according to our data as it stands. Advanced P4W, Peppermint and SOS/PracticeEvolve move only a few firms either way. On the numbers alone, you would say the duopoly is intact and the mid-tier is gently reshaping itself.

The picture becomes more interesting when you look inside the very largest firms. Norton Rose Fulbright’s move from a Fulcrum/SAP combination to Aderant Sierra gives Sierra a flagship global implementation and lifts the number of Sierra sites in the table to four, materially strengthening Aderant’s cloud story. For other large firms, it is hard evidence that Sierra is a credible option at Magic Circle / global-elite scale, not just in the mid-tier.

Clifford Chance, by contrast, has not yet made such a leap. It remains on the long-standing Keystone/Aderant set-up – effectively two systems bolted together – that dates back 25 years. Speaking as the consultant who helped kick off the original procurement, was part of the Keystone team that won the mandate, and was later re-engaged to assist with implementation, it is remarkable how long that alliance (resulting from Aderant’s acquisition of Keystone) has endured. The current configuration works, but only in the way that all well-maintained legacy systems work: through layers of fixes and workarounds. By any sensible benchmark, it is well overdue a full architectural overhaul, and we hear that it is currently under review.

The result is a PMS market that looks stable in aggregate but is clearly under renewed strategic scrutiny at the very top. Elite 3E and Aderant still dominate the counts, and most firms are sitting tight on their existing ledgers, but one global giant is actively re-platforming to Sierra while another is still running on a 25-year-old Keystone/Aderant combination that everyone expects to change. So far Fulcrum is the PMS of record at just a handful of firms. A step-change in references will now depend on more large-firm decisions crystallising in their favour.

For the rest of the market, the signal is nuanced: the PMS duopoly is not collapsing, but nor is it completely frozen.

Given the way in which the data is gathered, and the potential lack of differentiation between Aderant Expert and Aderant Sierra on the one hand, and Elite 3E and Elite 3E Cloud on the other, it may be that we are underestimating the Cloud shift. If we have missed any of these migrations, we implore firms to keep us informed so we can revise the table accordingly.

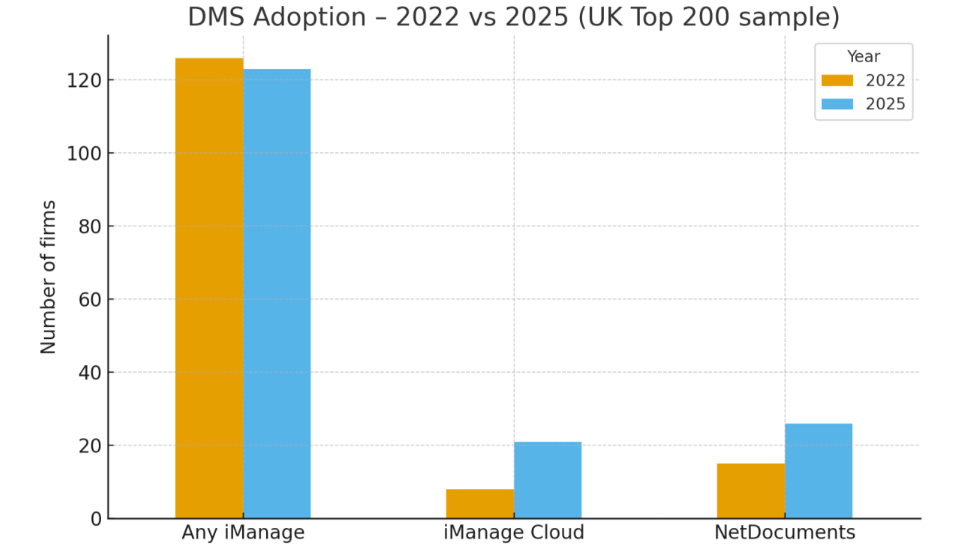

DMS – iManage holds, NetDocuments climbs, Cloud wins

The DMS story remains simple: another two-horse race, with iManage still covering just over half the firms in the table.

Within that base, the number of iManage Cloud sites has more than doubled as firms shift from on-prem iManage Work to Cloud hosting and modern workspaces. As with PMS, we may be under-valuing the Cloud element of iManage because some firms did not differentiate and thus Cloud may well be advancing faster than our labelling suggests. If any firm currently shows simply as “iManage” but has in fact migrated to iManage Cloud, please tell us and we will update.

NetDocuments is the one clear challenger, almost doubling its footprint and now into the mid-20s of firms. SharePoint-only DMS and other alternatives barely register as the system of record according to our data, however we know that outside of the UK Top 200 there have been some interesting shifts and this is an area to watch.

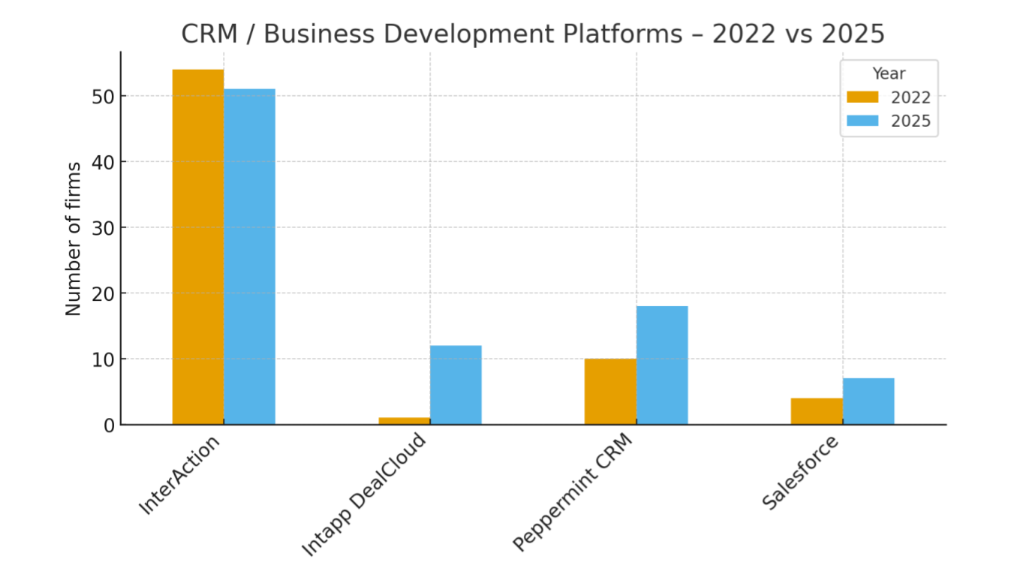

Business Development & CRM – InterAction ages, DealCloud arrives

InterAction remains the default CRM, slipping only slightly but still in roughly one in four firms – a decline that is likely to accelerate as systems age and integrations creak.

Intapp DealCloud moves from a rounding error in 2022 to double-digit adoption in 2025, and is now a serious option for deal-driven practices. From early research it appears that this trend is even more apparent in the US – as will be apparent when we release the US Top 200 update in the near future.

Peppermint CRM and Salesforce (and derivatives) both grow from small bases, typically where firms are re-thinking BD around Microsoft 365 or more modern marketing stacks.

Crucially, the “no CRM” bucket has all but disappeared: nearly every firm now has something recorded in CRM & Marketing.

BD has finally moved from “nice to have” to named systems with owners and budgets – whether firms stick with InterAction plus plug-ins or jump to DealCloud, Peppermint or a flavour of Salesforce.

Workflow, low-code and “the glue”

Under CASE–WORKFLOW–BPM and LOW CODE / NO CODE we see the gradual shift from monolithic case-management systems to process platforms and automation layers.

ShareDo and Peppermint both grow; MatterSphere and Visualfiles are still prominent but no longer the whole story and we can only expect more migration away from these aging systems. BRYTER and Power Apps/Power Platform are the most commonly named low-code tools, with Neota, Fliplet and others also appearing.

Many firms still do not badge anything formally as “low-code” – but the combination of BRYTER, Power Automate, PatternBuilder and DMS workflow shows that automation is happening, even if the branding lags behind.

This is where much of the interesting innovation now sits: gluing PMS, DMS, pricing and KM together rather than trying to replace them.

Collaboration, deal rooms and transaction tools

Collaboration is now mainstream, not an experiment. HighQ Collaborate is everywhere and essentially flat – it is already in most firms that want it. In NetDocuments shops, CollabSpaces is the natural counterpart and shows visible growth.

In transaction management, Orbital Witness remains a standout, with Legatics clearly gaining ground. They sit alongside HighQ, not in competition with it.

Clients increasingly expect portals, datarooms and closing trackers as standard; the table confirms that most large firms now have a recognisable toolkit in this space.

Security, risk and IG – mature, multi-layered stacks

Security looks markedly more grown-up than it did even three years ago:

Mimecast remains the de facto email security layer, often paired with Egress, Tessian and Proofpoint.

The CYBERSECURITY column now actually names vendors: CrowdStrike, SentinelOne, Darktrace, Arctic Wolf, Netskope, Rapid7, Tenable and others – frequently in layered combinations.

In RISK & COMPLIANCE we see Intapp and Tessian heavily represented, reflecting the emphasis on conflicts, walls and outbound email risk.

INFORMATION GOVERNANCE tools such as LegalRM, FileTrail, Intapp Walls and Microsoft Purview are beginning to crystallise.

The net effect is a properly layered security stack, not just “a good firewall and Mimecast”.

A Digression on Knowledge Management

It may seem that KM has disappeared, or become boring or obsolete; it hasn’t, it’s being reframed and embedded. In many firms it no longer presents as a standalone programme with its own branding and budget line. Instead it appears under “Knowledge & Innovation,” “Practice Technology,” or “Client Solutions,” where the emphasis is less on building libraries of precedents and more on operating the pipelines, policies, and permissions that make knowledge usable at scale. That shift can make KM look invisible, but its importance is rising, not falling – because Gen AI outcomes now depend directly on source quality, access control, metadata, and retention rules. Poor KM often translates into poor AI.

The centre of gravity has also moved from search to answers. Firms still need enterprise search, but the practical demand is for trusted snippets, checklists, and starting points with citations—assets that shorten cycle-time and reduce risk rather than simply returning long lists of documents. In parallel, “KM-in-the-loop” practices are emerging: KM teams curate sources, schemas, and guardrails for RAG/agent workflows, collect usage telemetry, and feed those signals back into curation so that the corpus improves over time.

From the outside this can look like KM is falling out of favour because less spend is explicitly labelled “KM.” In reality, the budget is being relabelled and redistributed across the DMS, drafting, workflow, data, and AI layers that now deliver knowledge in context. Where standalone KM still matters is in opinionated stewardship – maintaining precedents in regulated practices; defining firmwide taxonomies, ontologies, and matter-profiling; and publishing cross-matter playbooks and checklists that encode best practice and reduce variance.

Leading firms therefore treat KM as data operations for legal work: quality, lineage, and security wrapped around content and usage. They tie outcomes to pricing, profitability, and risk – measuring not document counts but reuse, start-up time, revision cycles, and error rates. In short, KM hasn’t faded; it has moved downstairs to the engine room. The firms that skimp on it may only discover the fact at inference time, when their AI starts to hallucinate.

BI, Costing and Data – Power BI everywhere

On the data side, Power BI is now the default BI front-end, sitting alongside specialists such as Katchr, BigHand and Iridium.

In MATTER PRICING / PLANNING, matter-costing modules of the mainstream PMS abound. Cosine still has the best-known dedicated product, but there is a visible ecosystem of Excel/Power BI-led models and newer tools such as BigHand Evaluate, Clocktimizer and CAEL. Aderant’s acquisition of Virtual Pricing Director should shake things up as they try to shoe-horn that into the user base in place of Aderant MatterWorks – another fun learning curve, as this genre of software is notorious for its complexity.

And for the avoidance of doubt, I will never stop banging on about the fact that what we are really talking about here is matter costing (the hard bit), not matter pricing (the comparatively easy bit).

Integration layers – Intapp Integrator, Azure Data Factory, Synapse, Boomi – are now routinely named in the DATA INTEGRATION column. Firms are finally treating data as a treasured proper platform, not just “some reports off the PMS”.

Automation, “classic AI” and Gen AI

The automation and AI story now breaks neatly into three strands – document assembly, classic legal AI, and Gen AI.

Document assembly

Clarilis strengthens its position as the go-to for complex automation. Contract Express remains widely deployed but is no longer the automatic first choice. HotDocs lingers as legacy and is unlikely to feature prominently in future cycles.

Classic legal AI

Tools such as Kira, Luminance and ThoughtRiver are present but still in a minority of firms, mostly at the top end, and generally focused on specific, well-defined use cases.

Gen AI

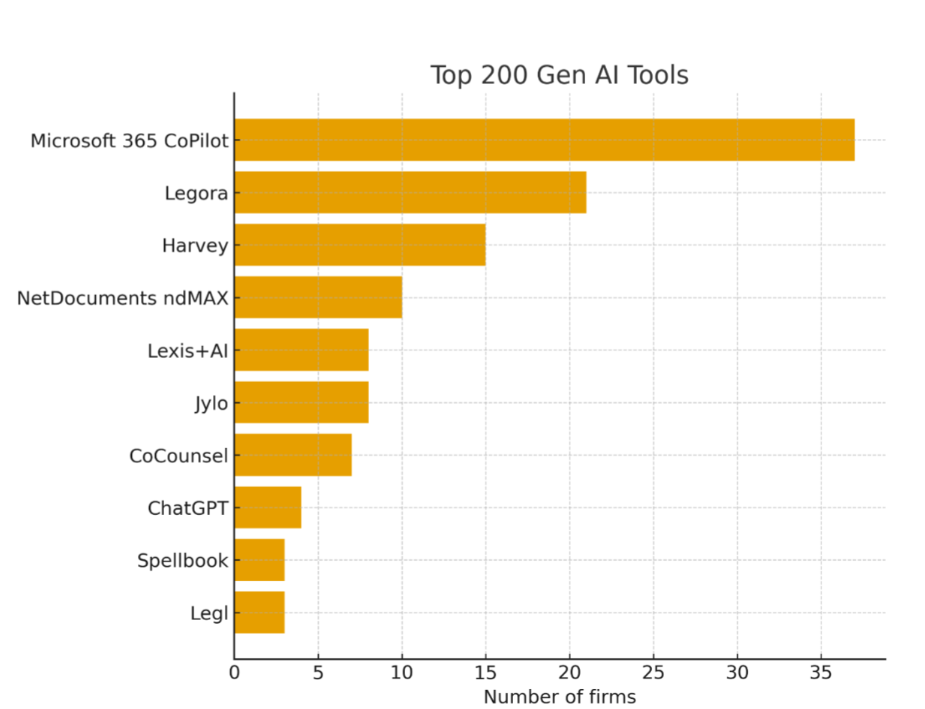

The new GEN AI column has gone from a curiosity to a crowded battleground. Just over 40% of firms in the table (96 of 221) now have at least one Gen AI tool, and those that do use an average of 1.8 products each – confirming that most firms are multi-homing, not backing a single horse.

Across the column:

- Microsoft CoPilot in its various flavours shows up in around 37 firms – by some distance the single most common Gen AI label, reflecting its position as an ambient AI layer in Microsoft-centric firms rather than a dedicated “legal AI system”

- Legora appears in around 21 firms, cutting across Big Law and the upper-mid tier, usually as a contract review or legal assistant platform

- Harvey is present in 16 firms, mostly larger practices, and typically alongside other tools

- ndMAX / ndMAX Assistant is named in around 10 firms, confirming NetDocuments’ success in turning Gen AI into part of the DMS fabric rather than a bolt-on

- Jylo appears in eight firms, often as part of broader “innovation” stacks

- CoCounsel appears in seven, usually in combination with other platforms

- Only four firms explicitly talk about “ChatGPT” into their tech stack, underlining the extent to which Gen AI is being productised and wrapped rather than simply letting lawyers loose in a browser

- A long tail of more specialised or in-house tools – Leah, Lauri Lawyer, Wexler, Jigsaw and firm-specific chatbots – appears in ones and twos.

Taken together, that paints a picture of a market where Gen AI is no longer experimental at the macro level – it is deployed in a meaningful way in nearly half the firms in the table – but is still messy and overlapping at the micro level. Most firms are running two or more tools in parallel and have not yet resolved which of those will be strategic and which will fade away. For now, Gen AI looks less like a new category of system and more like a pervasive layer sitting inside Office, DMS, KM, contract analysis and case-management tools.

Thus we can say: classic AI is embedded in a modest number of targeted use cases; Gen AI is everywhere, messy and overlapping, and may take several years to settle down into a recognisable pattern, but impossible to ignore.

Note on Gen AI reporting, it is even more difficult to keep up to speed on the adoption of Gen AI tools than other technologies, and few firms explicitly list their software. This means we have to build on inference even more than usual, and some elements will be missed.

For example, the table is probably under-counting Lexis+AI because we’ve only put it in where there’s clear, attributable evidence for a specific firm. But it is more complicated than that:

- Lexis’s own data shows much broader use: recent LexisNexis surveys say 61% of UK lawyers are already using Gen AI, and just over half of those use purpose-built legal AI such as Lexis+ AI. Obviously that reveals a potential for it being far more widespread than the eight of firms we’ve currently tagged

- Many firms get Lexis+ AI as an extension of their existing Lexis subscription, and treat it as “part of research” rather than something they issue a standalone press release about

- Marketing language is often fuzzy: lots of material says “developed with input from Firm X” or “Firm Y took part in the commercial preview”, which tells us they used Lexis+ AI but doesn’t always say “we have rolled it out firm-wide.”

Because of that, the Gen AI column today shows only the firms where we’ve seen explicit adoption/selection wording, but there may be many more. To repeat our plea to law firms in the User Notes; please help us keep an accurate record here by telling us what systems you use.

Final takeaways

The market has consolidated at the core: PMS and DMS are fairly stable duopolies with cloud migration rather than big-bang switches.

Around that core, firms are investing in workflow, collaboration, pricing, BI and security – the layers that change how work is actually delivered.

Gen AI has arrived fast and sideways: not as one magic legal-AI system but as a confused layer across multiple platforms, with many firms running several over-lapping tools at once.

The next three years are therefore unlikely to be about ripping out PMS and DMS. They will be about choosing the right automation and AI layers, rationalising overlapping Gen AI pilots into sustainable products, and working out which of today’s experiments harden into tomorrow’s core systems. This will probably come after a period of vendor consolidation (for some suppliers I predict a fairly bloody restructuring), as well as some law firms having to revise their Gen AI landscape to take into account which viable vendors are left.

Bullets:

- differentiation will come from workflow, collaboration, pricing, BI and AI.

- the real questions now are:

-

- which Gen AI tools become truly embedded?

-

- which remain as experiments?

-

- and how safely and coherently firms can integrate multiple AI engines into their existing stacks?

Methodology notes

The table ranks firms by reference to annual revenue figures and includes significant changes and updates from our last updated table in 2022.

In addition to our own proprietary legacy data, the UK Top 200 is the result of multi-prong research as well as direct engagement with law firms.

If a law firm has announced a future migration to a new platform we have used that information – on the basis that most users of the table are interested in current and future developments as opposed to history. However, if we find out that a planned migration has halted, regressed or changed tack, we will update the information accordingly.

There are some firms for whom we have no historical information, mostly due to the change in the Top 200 list itself. All these firm have been invited to provide us with their technology stack information. However, if none has been provided, the table will be empty or will contain information that we believe to be accurate from the sources previously stated.

We believe that we have a high degree of accuracy in this table, but if we have something wrong, then firms are welcome, indeed enthusiastically encouraged, to get in touch and correct our data. Please contact neil@legaltechnology.com or caroline@legaltechnology.com. We are on ET and GMT respectively.

The post UK Top 200 Tech Table 2025 – Consolidation, Cloud, and Gen AI appeared first on Legal IT Insider.